GREENSURANCE® OFFERS EXPANSION TO GERMAN INSURANCE MARKET

SUSTAINABLE FINANCE WITH INSURETECH GREEN.INSURANCE® and JustNow it gmbh

Greensurance® (green insurance® Germany) has been active in the German insurance market since 2005. We have been and still are pioneers of change towards a more sustainable insurance industry. For us, »Sustainable Finance« isn’t just smoke and mirrors – we live and breathe it.

Greensurance® deserves to become a Managing General Agent (MGA) – respectively a Coverholder, or even a primary insurer. And that’s why the founder, as the sole owner of all rights, is offering the trademark Greensurance® for expansion into the German insurance market.

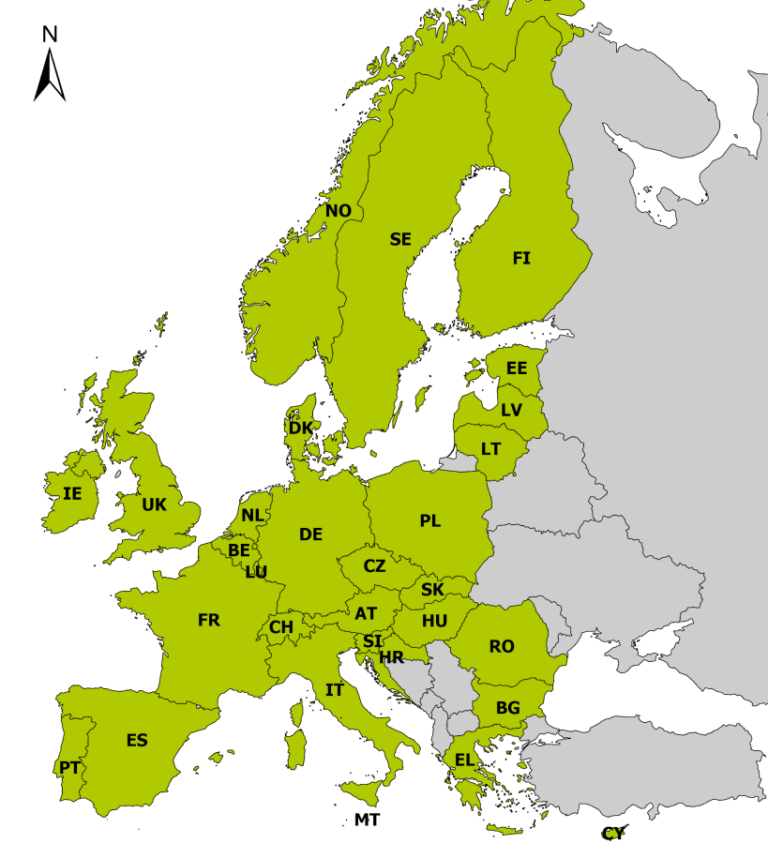

Greensurance® is a trademark protected in Europe, including countries such as Switzerland, Liechtenstein, England and Norway.

Greensurance® is seeking an impact investor who fits one of the following profiles:

- An insurer outside Germany who wants to enter the German market with Greensurance® as a Managing General Agent (MGA), respectively Coverholder.

- An insurer licensed to operate in Germany who invests in sustainable development through Greensurance® as a Managing General Agent (MGA), respectively Coverholder.

- Reinsurers making a strategic investment (< 50%).

- Software companies (IT) that want to invest in the expertise of our FinTech company, JustNow IT GmbH (a 100% subsidiary of Greensurance®).

Essentially, we are looking for a strong strategic partner. Additionally, we are happy to talk to business angels (VC, family office, silent partners).

Primary focus and markets

The primary focus is on Germany; however, other insurance markets that can be tapped into for

ASSEKURANZ in terms of sustainability and AI workflow automation include:

- Austria

- Switzerland

- Italy

- Liechtenstein

- Luxembourg

AI workflow automation

Greensurance® is not only a pioneer in sustainable insurance, but also demonstrates a transformative path with AI workflow automation. To this end, we have developed:

- greenInbox with greenBiPRO

- cashback for green

- greenCents

- Your own digital insurance manager with numerous landing pages

Domain portfolio

Greensurance® owns more than 800 domain names related to the sustainable insurance industry — including, without limitation:

green.insurance,

greensurance.de (.at, .ch, .it, .us, .ag, .green),

greeninsurance.de,

gruenversichern.de,

nachhaltigversichern.de,

as well as additional landing pages such as

gruenehaftpflichtversicherung.de or stromversicherung.de.

Client requests are exceeding our capabilities

And therefore, it’s our goal to expand! Ideally with our own sustainability wordings (as an underwriting agent / MGA) and an InsureTech focus based on sustainability.

The further implementation and development of AI workflow automation and the tapping into the broker market will take

Greensurance® together with JustNow IT GmbH to the next level.

The founder is offering an investment of < 50% or 50% + x%.

The minimum investment for < 50% is € 1.75 million.

JustNow IT GmbH

JustNow IT GmbH is a wholly owned subsidiary of Greensurance®. With a combination of:

- AI workflow automation

- greenBiPRO

- Dark processing

- Thinking outside the box – in the spirit of sustainability

we generate returns with a sustainability impact!

Authentic with Greensurance Foundation

The Greensurance Foundation impresses with true sustainability. As a change agent (pioneer of change), many strategic projects are directly related to the operational activities of Greensurance®.

A few examples:

- Emissions calculator with CO₂ compensation for sustainability bonus

- Hands-on climate protection with peatland renaturation (www.moorprojekte.de)

- ESG consultant training – Specialist consultant for sustainable insurance© (www.klimastrategen.de)

- Scientific positioning (including the Create research project)

- Driving force – e.g., for the Association for European Sustainable Insurers (www.assesi-label.eu)

There is a lot of useful information on the Greensurance Foundation website:

- www.greensurance-stiftung.de.

- Always helpful: Projects initiated through the Greensurance Foundation.

First mover

Insurance wordings with “additional benefits for sustainable compensation”, including in private liability insurance, were invented by the founder of Greensurance® and have been successfully introduced to the market.

Through the combination of insurance and additional sustainability services, Greensurance® has been operating successfully and authentically in the market for years. The Greensurance® team wants to scale this success!